The latest update from QRiskValue on the status of the current market as of 03/25/11.

The latest update from QRiskValue on the status of the current market as of 03/25/11.

Monday, March 28, 2011

Thursday, March 24, 2011

Housing

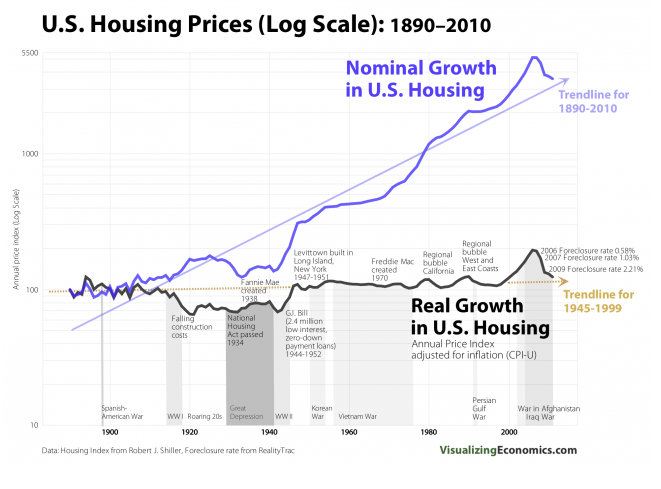

Real vs Nominal Housing Prices: United States 1890-2010

From Naked Capitalism

I try to avoid republishing other people’s very cool charts, but this is on a pet blog topic. So you readers please be very nice and go look at the accompanying text at Visualizing Economics and better yet, subscribe too (hat tip Richard Smith, click to enlarge):

This serves to confirm the idea that from a policy standpoint, housing is best regarded as a forced savings vehicle or a store of value rather than an investment.

Tuesday, March 15, 2011

Once Clubbed Once Warned

Recent data showing broader participation in stocks by those once burned comes at a time when indexes have almost doubled. The fact that the pros are selling it to them and providing another clubbing is too amazing. Gold and agricultural commodities generate fascination but are doomed to fall to earth leaving the same morons looking at their statements with the same agony as their 401K brothers.

Friday, March 4, 2011

Greenspan Recovery Plan X

Here is an article from the Washington Post.

Greenspan Says Government ‘Activism’ Hampering U.S. Recovery

March 3 (Bloomberg) -- Former Federal Reserve Chairman Alan Greenspan said a surge in U.S. government “activism,” including fiscal stimulus, housing subsidies and new regulations, is holding back the economic recovery.

Increased bond issuance by the Treasury Department crowds out borrowers with the weakest credit ratings, Greenspan said in an article in International Finance, published on the Web today. At least half of the shortfall in companies’ capital spending “can be explained by the shock of vastly greater government- created uncertainties embedded in the competitive, regulatory and financial environments” since the failure of Lehman Brothers Holdings Inc. in 2008, Greenspan said.

Greenspan’s conclusions fit with his long-held free-market ideology and may aid Republican lawmakers who argue that cutting federal spending now will help spur job growth. Critics including members of the Financial Crisis Inquiry Commission have said Greenspan’s failure to regulate the mortgage market last decade helped fuel the housing bubble whose bursting precipitated the financial crisis.

“Much intervention turns out to hobble markets rather than enhancing them,” said Greenspan, 84, who was appointed Fed chairman by Republican President Ronald Reagan in 1987 and served until 2006. “Any withdrawal of action to allow the economy to heal could restore some, or much, of the dynamic of the pre-crisis decade, without its imbalances.”

--Editors: Kevin Costelloe, Carlos Torres

Wednesday, March 2, 2011

Cuts Both Ways

Fed's Bernanke: Budget cuts could trim 200,000 jobs

(Reuters) - Federal Reserve Chairman Ben Bernanke said on Wednesday a Republican spending cut plan would not cause a big dent to U.S. economic growth, but could cost around 200,000 jobs.(Entire Article)