Thursday, July 31, 2008

All In or Pile Out?

There is a good chance tomorrow's close will indicate direction for the balance of the trading year. Any long term bear trend the bears may have hoped for rests on tomorrow's unemployment numbers. Awash in bale-outs and Fed interventions, the markets are sloshing around with enough cash to fix immediate problems, but raising cash may be easier than restoring confidence in an economy where consumers are finding all sources less willing to oil the big green lending machine. Should trade reaction interpret future job growth to be resilient, the all in bell will ring. On the other hand, no one likes rejection, but the bulls may find that piling on is an art form when price action turns ugly.

Not So Fast

Market a bit ahead of itself yesterday given the data being released today and tomorrow. Indexes will settle back and wait for unemployment data which may be crucial in determining the whether or not a real base can be built upon previous downside action. A hard break on Friday would create some serious trouble for the bulls and the argument that the various interventions have done the job.

Wednesday, July 30, 2008

Are Bears Missing Something?

The bears, whose numbers are vast, have had to stomach two sessions of short covering and pricing. But let's look at their strongest and weakest arguments about the direction down.

Strongest- Not since the 1930's has such contagious financial losses effected the bottom line in the bulge bracket sector.

If confidence is the name of the game in the making of long term success for investments and a willingness to lend money, then the bear may live in markets continuing to appear as if the worst is over only to see repeated failed rally attempts.

Weakest - Capitulation is the only way to a bottom. The end will come with such force and negativity there will seemingly be no hope for recovery.

Tough to base an argument on the ' know it when I see it ' rule. Bears need to be ready to accept that the speed of intervention by the G and Fed may have trumped the death dive.

Despite all the claims of the bears, great wealth on Wall Street is being created for those who are positioning themselves between bale-out and intervention. Hard to imagine the bears missing that one.

In any event, the ability for the market this week to put the lows behind rather quickly will be the tell on the upside strength. So far, it is still a range trade.

Strongest- Not since the 1930's has such contagious financial losses effected the bottom line in the bulge bracket sector.

If confidence is the name of the game in the making of long term success for investments and a willingness to lend money, then the bear may live in markets continuing to appear as if the worst is over only to see repeated failed rally attempts.

Weakest - Capitulation is the only way to a bottom. The end will come with such force and negativity there will seemingly be no hope for recovery.

Tough to base an argument on the ' know it when I see it ' rule. Bears need to be ready to accept that the speed of intervention by the G and Fed may have trumped the death dive.

Despite all the claims of the bears, great wealth on Wall Street is being created for those who are positioning themselves between bale-out and intervention. Hard to imagine the bears missing that one.

In any event, the ability for the market this week to put the lows behind rather quickly will be the tell on the upside strength. So far, it is still a range trade.

More Up

Stock indexes rejected Monday's break and now have a target placed on last week's highs. It will all come down to Friday action when the jobs number is released. A strong rally and close will confirm the worst is probably over for the year on the downside but yet leaving plenty of room for upside resistance. The question will be whether the price action will be enough to turn on the 'buy' math inside the production boxes in professional trading rooms which grind everyday. As posted earlier in Seed's of Summer, summer lows can lead to a significant upside gain over the next twelve months.

Tuesday, July 29, 2008

Bears Bomb

Reversal with better volume in the SP500 and NQ100 today as the DJI also turns around. Extreme bearish attitudes are the driving force that provide fuel for recoveries and are setting the stage for a test of the recent rally highs. The easy down is going to be a problem as mentioned before as the greatest marginal advantage has moved to the bulls.

Keeping Them Down

Dull morning after a decent down day as markets wait for various data releases. Bears need to keep the DJI, SP500, and NQ100 under last Friday's lows, being 11325, 1249.25, and 1815.25 respectively, if they are to prevent an up leg test of recent rally highs. Given the end of the world analysis presented every day by the pundits it should be no problem. Unless.

Monday, July 28, 2008

The Big Empty

Market moved lower again on moderate volume as the living dead were trotted out in the form financial stock woes and the pessimism of the IMF regarding the future of US housing. No one has ever cared what the IMF thought, but in a world of doubt, people would believe a talking dog. Merrill did not help things late when they announced a large write down and the intention to raise cash by issuing stock.

Today's action continues the first re-test of downside support created in mid July. The test of the first rally always provides only spotty low volume support. While there is no guarantee of the integrity of current lows, this test process is virtually unavoidable when there is such extreme bearish sentiment. Accompanying this particular break is a professional trading profile of sell side strategies somewhat unique since the advent of electronic trading. There are truly more hands pushing the cart down the hill, which of course, will only add to the chaotic scene of running up the hill when a serious short covering rally does appear. The bears can gain the upper hand by driving these markets into new lows at week's end but will have to convince traders that they are not selling the bottom, otherwise known as the big empty.

Today's action continues the first re-test of downside support created in mid July. The test of the first rally always provides only spotty low volume support. While there is no guarantee of the integrity of current lows, this test process is virtually unavoidable when there is such extreme bearish sentiment. Accompanying this particular break is a professional trading profile of sell side strategies somewhat unique since the advent of electronic trading. There are truly more hands pushing the cart down the hill, which of course, will only add to the chaotic scene of running up the hill when a serious short covering rally does appear. The bears can gain the upper hand by driving these markets into new lows at week's end but will have to convince traders that they are not selling the bottom, otherwise known as the big empty.

Flail About

Now the markets will see just how big the hole is in the side of the overall economy and whether the stimulus and relief packages will be enough to steady if not raise all boats. Bill Gross of Pimco, while not bullish on overall economic outlook, is on the other hand explaining the merits of investing in Freddie and Fannie as better than anything else on the risk side. Of course Pimco has a substantial position in the two and any spin Gross can add cannot hurt.

Hedge funds it appears may have had their worst month in five years according to Bloomberg. This is the result of deteriorating large bank positions and catch the falling knife purchases made when apparent bargains were appearing earlier this year.

Unemployment week is here along with several other bits of data so the market may flail about while trying to build a base for the balance of the year.

Hedge funds it appears may have had their worst month in five years according to Bloomberg. This is the result of deteriorating large bank positions and catch the falling knife purchases made when apparent bargains were appearing earlier this year.

Unemployment week is here along with several other bits of data so the market may flail about while trying to build a base for the balance of the year.

Friday, July 25, 2008

Taking Down For Granted

Covering a bunch of down territory yesterday with unimpressive volume and the same old news regarding banks and the economy. Bears must not get too comfortable in this environment because the illiquid nature of price in ranges such as these can provide as much energy on the upside.

Thursday, July 24, 2008

Breakdown

The repudiation break written about in the post Tactical Moves arrived today. Tomorrow will be of great interest as it will help determine whether or not today's wide range sell-off is part of an expanded range bottom or part of a more dismal directional pattern. IBM's strength and new eight year high could be the ultimate divergent clue for the indexes.

Dull Chop

Indexes ran into some selling yesterday but not enough to knock them around much. Volume was moderate as many waited to see if new buying would push markets still higher on this pricing and short covering rally. Housing data will be released today and commodities will try to regain some lost ground. Tomorrow's action probably more important than today's as it will give a clue as to the kind of volatility we will have through next week.

Wednesday, July 23, 2008

Tactical Moves

Commodities taking some hits as tactical attitudes shift on future price outlooks. Grains have had a great run but a growing unease about the ability of crops such as corn to maintain high prices as acres worldwide are expanding and the ethanol scam is running into some headwinds in states such as Texas that are seeking a waiver from EPA on blending. There is no question at some point the ethanol alternative energy plan will be virtually eliminated.

DJI, SP500 and to a lesser degree the NQ100 are continuing their run from the bottom. This combination of short covering and pricing reported in previous posts can lead to powerful rallies. Traders and investors should not forget however these rallies will crescendo at some point nearby and have a repudiation break with some force. Stories of the financially living dead will be resurfaced and the bull/bear battle will engage over a larger terrain.

DJI, SP500 and to a lesser degree the NQ100 are continuing their run from the bottom. This combination of short covering and pricing reported in previous posts can lead to powerful rallies. Traders and investors should not forget however these rallies will crescendo at some point nearby and have a repudiation break with some force. Stories of the financially living dead will be resurfaced and the bull/bear battle will engage over a larger terrain.

Tuesday, July 22, 2008

Down Is Out Today

Bears having trouble making headway as pricing continues to enter since the lows were made last week. Stocks such as AAPL today finished lower but had a huge rally off the lows. Markets will find path of least resistance on the upside into next week.

Marginal Advantage

The bears now face the some of the same merit of trend obstacles the bulls faced earlier this year. With diminished expectations just about everywhere, it is harder to use bad news as a instrument for downward pressure. If the most bearish are right, a grinding phase may be the be best the bears can achieve. Yesterday's bad news on earnings may help reveal whether the trading environment has changed to where the greatest marginal advantage has moved to the bull side. If so, the participants are looking for opportunities and not relief, which makes all the difference in trends.

Monday, July 21, 2008

Is It Safe?

Earnings this week with the cult AAPL releasing today. Flinging prices around will be the norm as the bottom boys press their case with solid gains from last week and the forever bearish will claim nothing has changed.

Is it safe? No. But the bias will remain up for the short term despite a few death dive looks. What traders have lost in trend is being made up for in range and volume. This just means there is an ability to be both right and wrong but still make money.

Is it safe? No. But the bias will remain up for the short term despite a few death dive looks. What traders have lost in trend is being made up for in range and volume. This just means there is an ability to be both right and wrong but still make money.

Sunday, July 20, 2008

Bears Waiting

Although a decent rally has occurred, the bank and financial stories will be back since it is hard currency to the bears. Without the fees of M&A, Sub-Prime, and the willing buying a bull market brings, brokerage and hedge have their best interests in the downside. So after the current pricing and short covering runs through July, the shadows will reappear. The old pit adage of ' never buy the first rally ' may be the bear's best ally.

Saturday, July 19, 2008

Baseball / More Rally

teams, players, and parks match the world where numbers count. More baseball later.

Markets this week started rejecting the over extended selling of the past weeks and now the bears will have to turn a market while a significant amount of pricing will be taking place. It does not take much buying when competing with short covering to drive the markets a bit higher than the gloom of early last week had anticipated. So expect more rally before the bear can launch a counter attack.

Friday, July 18, 2008

Will Tech Show Up ?

Whether this rally becomes a romp on a large stagnant bear complacency will be determined in the next two weeks. Regardless, the often times refrain from bulls of cash on the sidelines is finally true. There is enough energy which could be applied to this market when making a play for six months or a year out. Although the broader market will be the initial leader, tech stocks will have to kick in and lead or else any hopes for an extended rally will fail quickly.

Thursday, July 17, 2008

Wednesday, July 16, 2008

Seeds of Summer?

When DJIA makes lows in summertime;

Aug of 1982 had a low of 770 with the following August close of 1216 +58%. June of 1984 saw a low of 1082 with the following August 1985 close of 1334 or +23%. July of 1996 low 5170, following August 1997 close of 7622 or +47%. September of 1998 low of 7400 and following August 1999 close of 10829 +44%.

Aug of 1982 had a low of 770 with the following August close of 1216 +58%. June of 1984 saw a low of 1082 with the following August 1985 close of 1334 or +23%. July of 1996 low 5170, following August 1997 close of 7622 or +47%. September of 1998 low of 7400 and following August 1999 close of 10829 +44%.

Relative Strength

Tuesday, July 15, 2008

The Great Bank Spinnery

Great chart on Calculatedrisk.blogspot.com about the average number of bank and thrift failures per year. The 1980's bank failures were huge and were just getting going when the greatest stock market rally of the century was just beginning in August 1982. As the chart reveals, from 1986 through 1992, banks and thrifts were averaging over 200 failures per year with over 500 in 1989. That year the DJIA rallied over 26%. You will not here it from the spinners on market news coverage because they love to stretch a good story based on data with no greater credibility than rumor. I am no bull as a history of this blog will attest, but from market bloggers to magazines, the negative feeding frenzy about current economic conditions is a joke. Fact is, from subsidized farming, to subsidized oil production, great interventions lead to significantly higher prices for whatever the federal of Fed green giants are accommodating. And they are pointing at stocks. The G is covering almost every marker out there and sewing the seeds for a run for the well baled. Don't kid yourself, this is all about fixing the up while everyone else is looking down.

Bouncing Around

The search for the lows of a move are always uncomfortable because they always appear when everything seems to be the gloomiest. The bears have had a move where they have finally made some money after several years of spinning their wheels. Right now they are driving but fortunes change quickly.

Bernanke will speak today so their will be extra chopping around as his verbiage is revealed. The market will need a bit of surprise in either economic data or in the Fed language to get some traction.

Bernanke will speak today so their will be extra chopping around as his verbiage is revealed. The market will need a bit of surprise in either economic data or in the Fed language to get some traction.

Monday, July 14, 2008

Base Building

As mentioned here on Friday morning, some type of arrangement was going to be made in regards to Freddie and Fannie. It is not a cure for all the problems of this down market but it once again puts federal institutions into the mix which absolutely dilutes some of the downside potential of the market. Lots of earnings and other economic data for the over-traders to digest as the indexes start to consolidate a base over a fairly wide range.

Sunday, July 13, 2008

Bear Fish

Back on October 9th 2007, two days before the DJIA made an all time high, I posted a piece called Bull Fish examining the excesses of the bull feeders at a time when the market was chasing prices up with the same intelligence that it is currently selling prices off, little. While there have clearly been dynamic disruptions in the mark to market aspects of debt paper and subsequently real financial hits as well as a loss of confidence in some financial business operations, the bear has completely been consumed with a reasoning which dismisses the massive monetary intervention taking place. Betting against the Fed's ability to regulate this current weakness with a Fed Chairman who will spare no efforts in avoiding having his name next to a historical footnote which reads ' see Hoover', is a tactical blunder.

The break has now become a media event hyped with the same market format hysteria which drove the bull side crap for years. Investing in down has become a marketable strategy in an environment without any confidence in presidential leadership or the stewards of brokerage and banks. Anyone with any significant professional trading experience will tell you that big down pays off much quicker that big up. Having been left with idiotic strategies which could not cover any meaningful downside risk in a sub prime environment, hedge firms and big brokerage have moved to quick adaptive sell side strategies. This is not to be conspiratorial, rather strategies have emergent characteristics which lend themselves to be adopted by everyone as was clearly demonstrated when all ended up with the same sub prime calculated risk formulas.

Just as a significant segment of professional managers misread the structure of market price value earlier, we have entered a price trap scenario where the price liquidity could be tenuous for those needing to cover. This is not the beginning of a new bull phase but a mechanical reaction triggered by the velocity of preposterous positioning.

The break has now become a media event hyped with the same market format hysteria which drove the bull side crap for years. Investing in down has become a marketable strategy in an environment without any confidence in presidential leadership or the stewards of brokerage and banks. Anyone with any significant professional trading experience will tell you that big down pays off much quicker that big up. Having been left with idiotic strategies which could not cover any meaningful downside risk in a sub prime environment, hedge firms and big brokerage have moved to quick adaptive sell side strategies. This is not to be conspiratorial, rather strategies have emergent characteristics which lend themselves to be adopted by everyone as was clearly demonstrated when all ended up with the same sub prime calculated risk formulas.

Just as a significant segment of professional managers misread the structure of market price value earlier, we have entered a price trap scenario where the price liquidity could be tenuous for those needing to cover. This is not the beginning of a new bull phase but a mechanical reaction triggered by the velocity of preposterous positioning.

Friday, July 11, 2008

More Nerves

Markets nervous about Freddie, Fannie, and Israel. Nothing new but when you are trading in this volatility few price levels are safe. Some type of supervision or takeover of Freddie and Fannie will happen just to keep some sort of confidence edge. Markets were hoping to close higher on week with new lows being made but that may be a problem.

Thursday, July 10, 2008

Profiles Of Gloom

When looking the current patterns and the make-up of the market participants of this volatile spinning market, various trader profiles emerge from the past. I am not talking about the trader folks on Wall Street coming out of Ivy League schools who transact and call it trading. I'm talking about the real traders with skills honed in trading pits. Tough, big mouths who love to be miserable. Who always complain about being abused by the market as if they never made a dime. The big pit traders with hands in or out willing to step into a big trade, as long as it is winked into them quickly in busy markets and few see it. Then complain that every one else in the pit is a scumbag for not making a market for them when they needed to pick someone off. The constant bulls who have no particular trading skills and are only a little more stupid than the forever bearish who at least has some self respect. The moderate size trader, neither bull nor bear, who likes to dress himself rather than be set up by a filling brokers. The small trader who thinks everyone is an idiot for trading but makes more money than anyone else.

Trading is tough. The black box strategies speed up the game and change the profile of the market a bit. It is now filled with the ' modified bull/bear high frequency get some transactional kickback oh yes sometimes we cross orders but the exchange does not care' traders. And when groups of high frequency traders get together with everyone else, the market spins like a greased beach ball being passed along by throngs of market concert fans. Algorithmic trading is not a negative as some believe. Increasing volatility usually expands opportunities if it has corresponding increasing volume, which is certainly the case today.

Analyzing the markets has become great theater. Lately, the continuing drama of gloom is being portrayed by pundits such as CNBC's Ron Insana, who may come to be known as ' the great extrapolator' for his visionary work in connecting all stocks in a straight line down. Listening to Insana talk, one would think there is some incomprehensible misery lying ahead incapable of being repaired without some historical downside cleansing. What is clear is that Ron probably learned everything he knows about trading from reading a teleprompter. Trying to catch it all in some dire broad macro analysis is easy but lazy. Pointing a big arrow down is entertaining for some but ultimately valueless. Insana and others credibility are now invested in disaster. Tough trade.

Trading is tough. The black box strategies speed up the game and change the profile of the market a bit. It is now filled with the ' modified bull/bear high frequency get some transactional kickback oh yes sometimes we cross orders but the exchange does not care' traders. And when groups of high frequency traders get together with everyone else, the market spins like a greased beach ball being passed along by throngs of market concert fans. Algorithmic trading is not a negative as some believe. Increasing volatility usually expands opportunities if it has corresponding increasing volume, which is certainly the case today.

Analyzing the markets has become great theater. Lately, the continuing drama of gloom is being portrayed by pundits such as CNBC's Ron Insana, who may come to be known as ' the great extrapolator' for his visionary work in connecting all stocks in a straight line down. Listening to Insana talk, one would think there is some incomprehensible misery lying ahead incapable of being repaired without some historical downside cleansing. What is clear is that Ron probably learned everything he knows about trading from reading a teleprompter. Trying to catch it all in some dire broad macro analysis is easy but lazy. Pointing a big arrow down is entertaining for some but ultimately valueless. Insana and others credibility are now invested in disaster. Tough trade.

Wednesday, July 9, 2008

Prone To Hyperbole

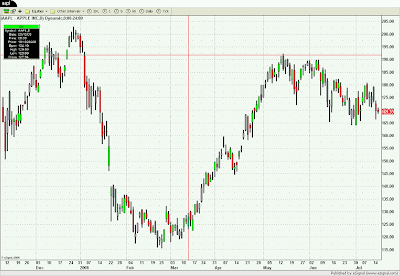

These are tough volatile markets and for all traders, it is full of opportunities which change on a daily basis. When you step back and look at the market in a broader perspective, the ability to see how the market overplays moves is better appreciated. Here is a chart of the spot SP500 emini futures against a proprietary model which calculates fair value by various performance criteria. Similar to a previous posted chart but a bit less harsh on just how much the SP500 is undervalued.

These are tough volatile markets and for all traders, it is full of opportunities which change on a daily basis. When you step back and look at the market in a broader perspective, the ability to see how the market overplays moves is better appreciated. Here is a chart of the spot SP500 emini futures against a proprietary model which calculates fair value by various performance criteria. Similar to a previous posted chart but a bit less harsh on just how much the SP500 is undervalued.

Plenty Of Action

Plenty going on yesterday. Indexes along with DJIA played with and then committed to a late rally. Previous day' action hinting Freddie and Fannie might have to raise additional capital seemed to fade along with continued pressure on crude prices all helped to clear some room for a rally. Though price action was constructive, there is enough volatility to keep all traders somewhat uneasy.

Tuesday, July 8, 2008

Chopping Around

Volatile trade already today as Bernanke talking about extending help to investment banks if needed. Trade trying to establish the base of the summer range with willing sellers all about.

Market will try to stage a rally over yesterday's highs but only a close above them will build any footing.

Market will try to stage a rally over yesterday's highs but only a close above them will build any footing.

Monday, July 7, 2008

Pointing South

The worst of all worlds for markets is when stocks and commodities get rolling down together. Any look of a deflationary charge is enough to make buyers back-off. It just may be the pumped up volatility of all markets but just in case there is a general unease in today's trade. Grains, crude, and gold are getting whacked along with Freddie Mac and Fannie May bombing with about 20% declines each.

Fear and Loathing

Market trying to rally and is overdue for some relief. Just the current fear of buying has become a impediment to any advances. Clearly the break has been overdone but any negative news from banks and brokerage will keep market nervous.

Sunday, July 6, 2008

Under Value ?

Could the market have it all wrong? These models are based on a criteria for price buy/sell performance of the underlying trend. In other words, the market's trend strength is measured by the execution of price value areas established by the daily price construct. The underlying market usually does not stray to far from value, but these are extraordinary times. The chart above contains the NQ100 G model for additional

comparison.

Saturday, July 5, 2008

Deep Won't Sell

Wednesday, July 2, 2008

Rally Off Lows

Markets looking to extend yesterday's turn around from the lows as the official bear market so far lasted less than four hours. Traders do not care about official labels as to a bull or bear market, most have trouble reading. The bears have had decent break inside a long term bull market and should be thankful since in general it has been a tough couple years for them.

Tuesday, July 1, 2008

Pressure Early

Markets under pressure this AM as the third quarter begins. Middle East potential events as well as extremely bearish forecasts for the balance of the year. Being nimble around panic is difficult but the trader will find opportunity about the makings of a bear bubble as they did around the bull bubble.

Subscribe to:

Posts (Atom)